SORCE Insights: An Initial Look at the Anticipated Impact of Tariffs on Fourth District Businesses

The Cleveland Fed’s Survey of Regional Conditions and Expectations (SORCE) administered in February 2025 asked respondents from across the Fourth District a set of special questions about the potential impact of tariffs on their business. This District Data Brief analyzes their responses.

The views authors express in District Data Briefs are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Harrison Markel.

Introduction

The Cleveland Fed’s Research Department gathers and analyzes timely economic information from businesses and community contacts to inform our Beige Book contribution and preparation for Federal Open Market Committee (FOMC) meetings. One way we obtain this information is through the Survey of Regional Conditions and Expectations (SORCE), a business conditions survey sent to firms across the Fourth District.1, 2 The SORCE is administered eight times per year. In addition to the set of standard questions asked during each round of the survey, the Cleveland Fed routinely asks a set of “special questions” to explore timely issues that may be impacting businesses across the Fourth District. In the version of the SORCE fielded during February 6–13, 2025, the Cleveland Fed asked respondents a series of special questions regarding the potential impact of tariffs on their business. The responses are analyzed below.

Analysis

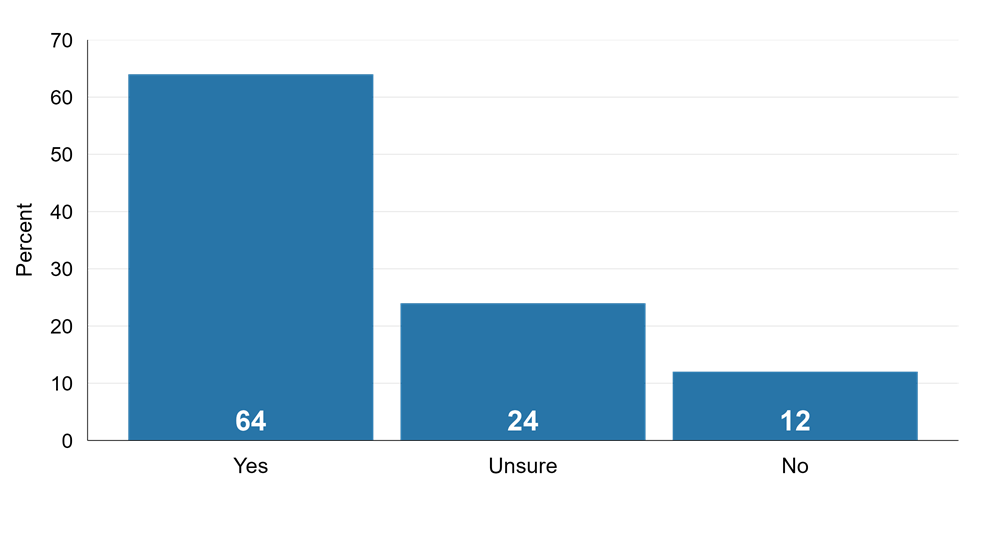

The first of these special questions, which was used as a filter to determine whether respondents would proceed to additional questions, asked, “Would tariffs on imports impact your business?” (Figure 1). Around two-thirds (64 percent) of respondents said that tariffs would impact their business, while 12 percent said that they would not. Another 24 percent of respondents said that they were unsure if tariffs would impact their business.

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “Would tariffs on imports impact your business?” There were 144 responses.

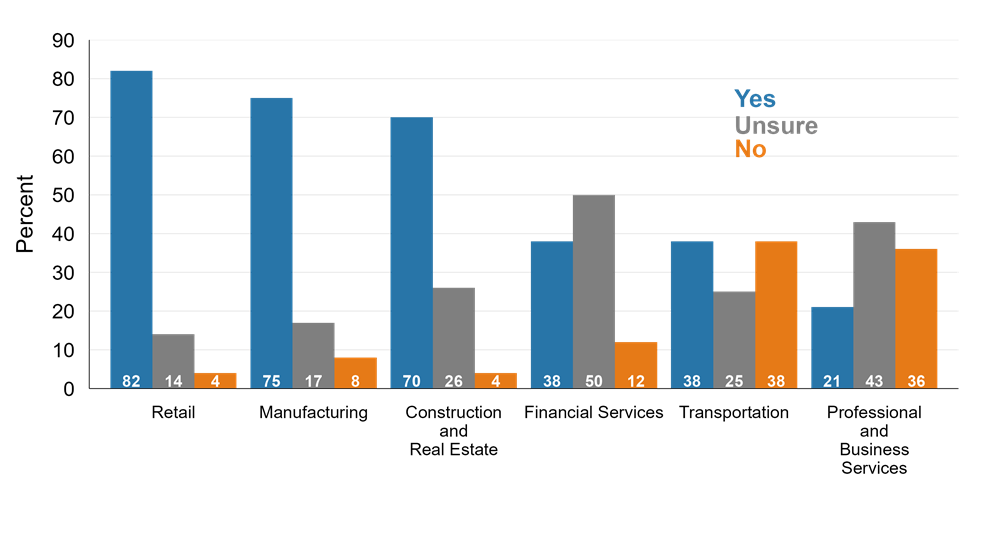

Figure 2 highlights the percentage of respondents from each industry who said that tariffs would impact their business. Eighty-two percent of retail respondents, 75 percent of manufacturing respondents, and 70 percent of construction and real estate respondents said that tariffs would impact their business. A much smaller percentage of respondents in financial services (38 percent), transportation (38 percent), and professional and business services (21 percent) said that their business would be impacted.

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “Would tariffs on imports impact your business?” There were 125 responses. The data exclude industries not classified in one of the major sectors specified in Figure 2.

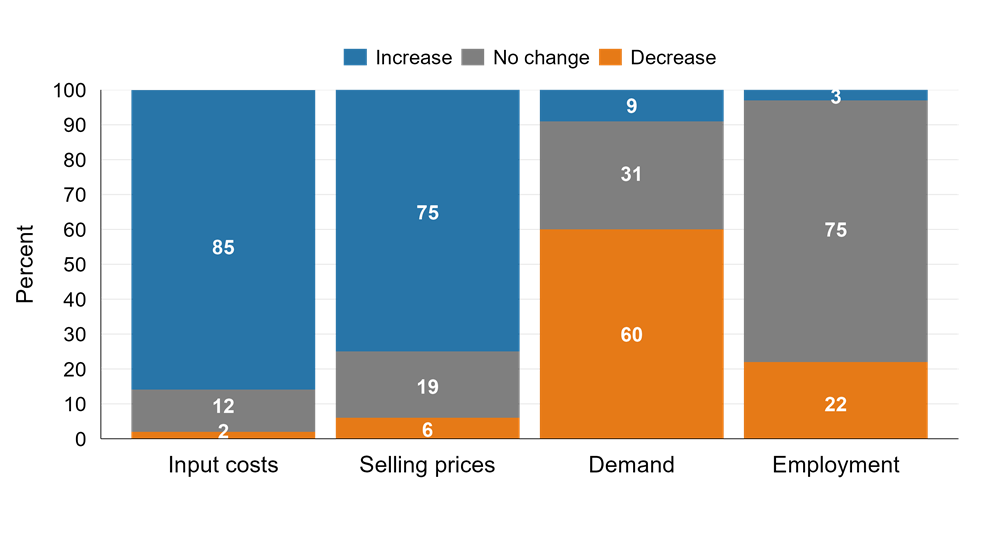

Respondents who said that their business would be impacted by tariffs were asked additional questions. These questions assessed whether they anticipated that tariffs would increase, decrease, or have no effect on demand, input costs, selling prices, and employment (Figure 3). Sixty percent of those respondents said that demand for their products or services would decrease because of tariffs, 31 percent anticipated no change in demand, and 9 percent said that demand would increase.

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “How would tariffs on imports impact the following areas of your business?” Regarding the potential impact on input costs and selling prices, there were 89 responses, while there were 88 and 87 responses regarding the potential impact on employment and demand, respectively.

A strong majority (85 percent) of these respondents said that tariffs would increase their input costs, while another 12 percent expected no change in their input costs. Seventy-five percent of these respondents said that tariffs would cause them to increase their selling prices, 19 percent expected no change in their selling prices, and 6 percent anticipated that they would decrease their selling prices. Finally, while the vast majority (75 percent) of respondents said that tariffs would not cause any change in their employment, 22 percent said that tariffs would cause a decrease in their employment.

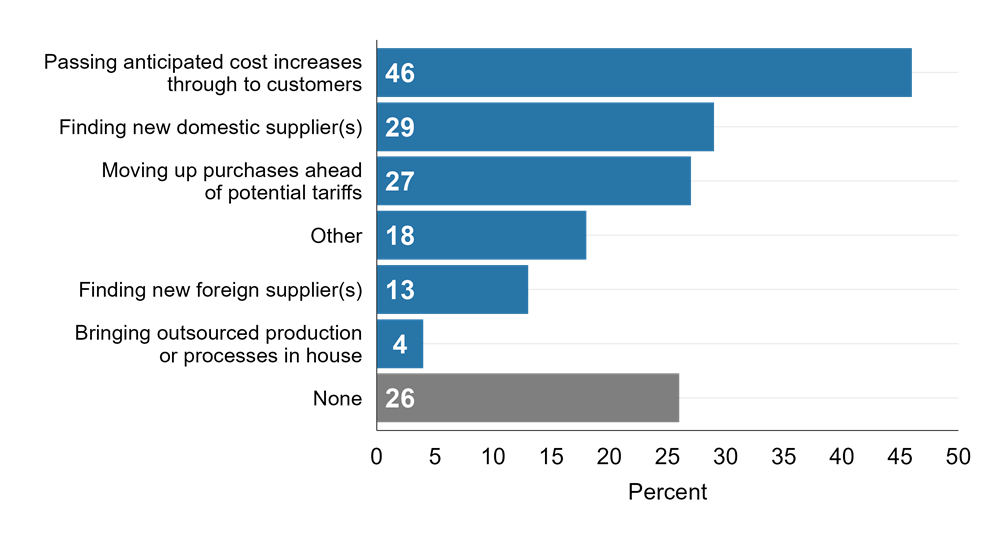

We then asked respondents who said that their business would be impacted by tariffs to describe what actions, if any, they expect to take or were taking in anticipation of tariffs (Figure 4). Forty-six percent of these respondents said that they were passing or anticipated passing cost increases through to customers, and 29 percent said that they planned to seek or were actively seeking new domestic suppliers. Twenty-seven percent indicated that they were pulling forward purchases ahead of potential tariffs. Finally, 13 percent said that they were seeking or anticipated seeking new foreign suppliers, and 4 percent said that they were exploring bringing outsourced production or processes in-house.

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What actions, if any, are you taking in anticipation of tariffs on imports?” There were 91 responses. Respondents were allowed to select multiple categories (other than “none”).

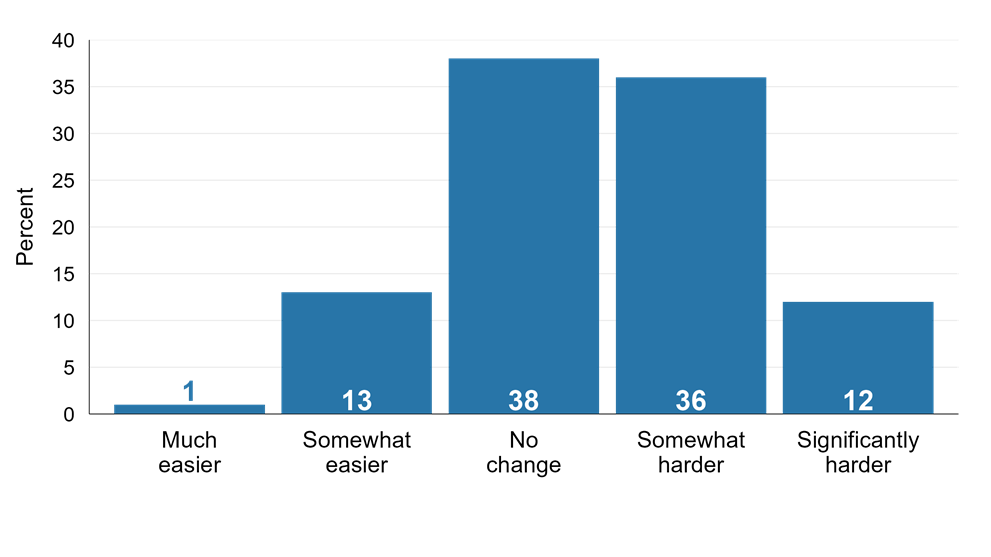

Finally, we asked a question to assess the environment in which respondents would be attempting to pass price increases along to customers in response to tariffs (Figure 5). Respondents were asked to compare the ease of passing along price increases to customers versus one year ago. A combined 48 percent of respondents said it was somewhat or significantly harder than one year ago to pass along price increases to customers. Thirty-eight percent of respondents said there was no change in the ability to pass along price increases, while a combined 14 percent said it was somewhat or much easier to pass along price increases to customers compared to one year ago.

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on answers to the question “Compared to this time last year, how has your firm’s ability to pass price increases on to customers changed?” There were 143 responses.

Conclusion

In the Cleveland Fed SORCE administered in February 2025, a majority of respondents (64 percent) indicated that their business would be impacted by tariffs on imports. Respondents in retail, manufacturing, and construction and real estate were more likely to anticipate being impacted by tariffs than contacts in financial services, transportation, and professional and business services. Sizable majorities of respondents expected tariffs to increase both input costs and selling prices while decreasing demand for their products and services. In anticipation of the potential effects of tariffs, respondents indicated that they were taking or are expecting to take a variety of actions including seeking new domestic suppliers, pulling forward purchases, and passing along increased costs to consumers. However, many respondents anticipated that it would be more difficult to pass along higher costs to their customers compared to one year ago.

Footnotes

- For more information on the SORCE, please visit https://clevelandfed.org/sorce. Return to 1

- The Fourth District of the Federal Reserve System comprises Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. Return to 2

Suggested Citation

Mills, Russell, Jayme V. Gerring, Brett Huettner, and Brooke Dirtzu. 2025. “SORCE Insights: An Initial Look at the Anticipated Impact of Tariffs on Fourth District Businesses.” Federal Reserve Bank of Cleveland, Cleveland Fed District Data Brief. https://doi.org/10.26509/frbc-ddb-20250422

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

- Share

Regional Data, Analysis, and Engagement

Explore economic trends and the circumstances impacting the economy and diverse communities of the Federal Reserve’s Fourth District, which includes all of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.