QT, Ample Reserves, and the Changing Fed Balance Sheet

The Federal Reserve’s Federal Open Market Committee (FOMC) influences market interest rates by changing the administered rates that it controls, such as the interest rates on overnight repurchase and reverse repurchase agreements. This requires an ample level of bank reserves. Quantitative tightening (QT) reduces the level of reserves. To guard against supply and demand shocks that drive reserves too low, the FOMC may need to hold a buffer above the point at which reserves become scarce. In this Economic Commentary, I present evidence based on inventory theory that the estimated buffer might be relatively small, though the true number is uncertain. Treating the Federal Reserve’s balance sheet as inventory helps to estimate the level of reserves needed to stay above the scarce threshold.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The Federal Open Market Committee (FOMC) influences market interest rates by changing the administered rates that are within the control of the Federal Reserve, such as the interest rates on overnight repurchase and reverse repurchase agreements, and the interest rate on reserve balances that is set by the Federal Reserve Board of Governors. This method requires that reserves be ample, or large enough so that small shifts in the supply of and demand for reserves do not change interest rates. This implies a correspondingly large balance sheet. As the Federal Reserve reduces its balance sheet through quantitative tightening (QT), it must keep reserves at or above that ample level to avoid going back to the old way that it controlled rates before the great financial crisis, when reserves were much lower. The FOMC must confront the trade-off between the costs of a large balance sheet and the possibility that shifts in the demand or supply of reserves could affect the federal funds rate; however, opinions differ on how to weigh these costs. This Economic Commentary explains the challenges involved and suggests that treating the balance sheet as an inventory problem could be a useful approach to address this issue.1

Reserves: Scarce, Ample, and Abundant

Prior to 2008, the Federal Reserve would raise or lower interest rates by increasing or decreasing the amount of reserves that banks held by buying or selling government securities. Selling securities reduced the size of the Fed’s balance sheet and decreased the level of bank reserves, a strategy which, in turn, increased the federal funds rate, the rate at which banks trade reserves. In this case, reserves were “scarce,” meaning the federal funds rate moved with small changes in the supply of reserves.

After 2008, the Federal Reserve, in response to the Great Recession, flooded the market with reserves, buying large quantities of US Treasury debt and mortgage-backed securities, in a process commonly call quantitative easing (QE). Since reserves were no longer scarce, buying or selling a few additional securities no longer had a noticeable impact on the federal funds rate. Also, in 2008, the Fed started paying interest on reserves.2 Banks could then hold reserves and receive interest on them. This change allowed the Fed to influence interest rates even if there was a large or very large quantity of reserves available, what policymakers have referred to as “ample” and “abundant” quantities, respectively. Thus, after a long spell at effectively zero, when the FOMC raised its target for the federal funds rate for the first time in December 2015, this was accomplished by increasing the interest rate paid on reserve balances (set by the Federal Reserve Board) and increasing the rate for overnight reverse repurchase agreements, not by selling assets and reducing reserves. This situation, in which the federal funds rate is determined not by adjusting the supply of reserves but by changing an administered interest rate, works only if there are enough reserves. This way of implementing policy became known as the “ample reserves regime” (see Wolla, 2019; Board of Governors, 2019). The FOMC formally adopted this regime in January 2019.

The large balance sheet during the Great Recession had two advantages. It stimulated the economy, and it also allowed the FOMC to control interest rates by moving administered rates, that is, rates set by the Federal Reserve, such as the interest on reserve balances (IORB), rather than by adjusting reserves to offset shifts in the demand and supply of reserves. However, this meant that when the economy started to recover and the added stimulus was no longer needed, it was time to shrink the balance sheet, a process which was achieved through QT.

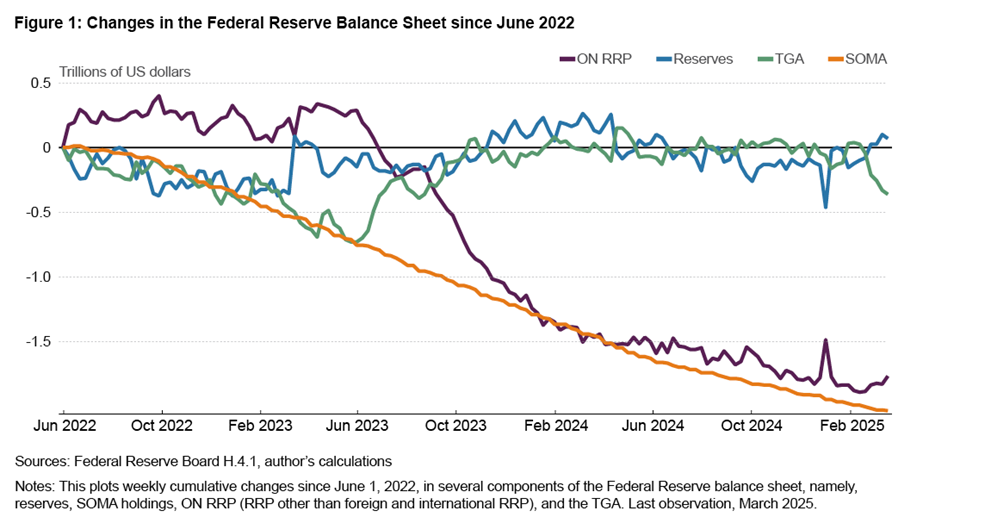

More generally, a large balance sheet comes with potential drawbacks. As the minutes to the November 2018 meeting of the FOMC put it, these included “challenges in precisely determining the quantity of reserves necessary in such systems, the need to maintain relatively sizable quantities of reserves and holdings of securities, and relatively large ongoing interest expenses associated with the remuneration of reserves.” With regard to the broader economy, a large central bank balance sheet means that the banking system is holding many reserves, something which could crowd out bank lending. Furthermore, holding US Treasury and mortgage-backed securities soaks up scarce and valuable collateral used by others in financial markets.3 One peculiarity of QT during this time period was that reducing Federal Reserve holdings of securities, at least initially, had little impact on the level of reserves because the Fed had other assets and liabilities that also moved around. Two important liabilities particularly affect the level of bank reserves: the Treasury general account (TGA) and the overnight reverse repo program (ONRRP). Just as reserves are a bank’s account with the Fed, the TGA is the US Treasury’s account, and when the US Treasury spends money or pays businesses, money moves from the TGA to bank reserves. Likewise, the Fed can temporarily lend securities to banks and other entities, reducing reserves via the ONRRP.

Since the start of the most recent round of QT in June 2022, the overall Federal Reserve balance sheet has dropped by $2.19 trillion, and total security holdings have dropped by $2.05 trillion.4 Figure 1 shows the changes in the Federal Reserve’s System Open Market Account (SOMA) holdings, reserves, ONRRP balances, and the TGA from June 2022 to March 2025. Clearly, reducing the size of the balance sheet at this pace cannot continue forever; at some point, all the securities will be sold.

How far can QT go?

One limit to the extent of QT is the need for the Federal Reserve to back currency. Currency in circulation—or “cash,” more informally—is a liability of the Federal Reserve and must be backed by its assets. Though far below the level of all SOMA assets, at $2.3 trillion, the amount of cash grows with the economy and thus puts a hard limit on how far Fed assets can shrink. A more immediate limit is the level of reserves. Once the ONRRP level stops shrinking, either because it hits zero or financial institutions become satisfied with a low level, the roll off of securities will shrink total bank reserves almost one for one, taking them from their current “abundant” level to a lower “ample” level. If QT continues, then beyond a certain point they would eventually fall into the “scarce” range, barring offsetting changes in other components such as the TGA. In that case, monetary policy would be back in the pre-global-financial-crisis situation where the federal funds rate changes when reserves change, precisely because they are relatively scarce. However, the FOMC explicitly announced in January 2019—and reaffirmed in January 2022—that it plans to stay in an ample reserves operating procedure in which reserves are high enough that it can change the federal funds rate by changing the IORB and the ONRRP rates (FOMC, 2019), effectively setting a limit to how far QT can proceed.

To determine that limit, the FOMC faces two challenges. The first is to find the transition point at which ample reserves end and reserve scarcity starts, all in the context of a money market facing its own set of shocks. Some evidence comes from the run-up of the balance sheet and reserves in 2008, with additional evidence from the first bout of QT in 2017–2019; however, these are only two brief episodes and are thus limited in terms of their illustrative purposes. The second challenge is that some liabilities lie outside of the FOMC’s control. While it is possible that there might be a large change in currency demand, the TGA is the more variable factor.5 Over the past five years, the TGA has reached as high as $1.79 trillion and as low as $49 billion; the average weekly change was $54 billion, with the largest weekly change exceeding $333 billion. On top of that, the demand for reserves by banks may fluctuate, though this is somewhat difficult to determine since QE has provided more reserves than banks currently demand.

Therefore, the FOMC confronts a rather delicate balancing act, facing a trade-off between a large balance sheet and the chance that random shifts in the demand or supply of reserves could unmoor the federal funds rate. Opinions differ on how to strike the balance: a pair of current and former Fed officials argued that the “minimum level of reserves is conceptually murky, impossible to estimate, and likely to vary over time. The best approach is to steer well clear of it, especially since maintaining a higher level of reserves as a buffer has no meaningful cost” (Gagnon and Sack, 2019). On the other hand, the FOMC has stated that the “SOMA would hold no more securities than necessary for efficient and effective policy implementation.”6

There has been limited probing of the boundary between reserves being scarce, ample, or abundant, and, consequently, estimates of the boundaries between these concepts are less than precise. The Federal Reserve Bank of New York, in its projections of how the balance sheet might evolve, has used reserves of between 8 percent and 10 percent of GDP as an indication of ample (Federal Reserve Bank of New York, 2024). Several other people have tried to estimate the demand for reserves, looking for the point at which reserves again become scarce, but answers vary. Some estimates put it as low as 7 percent of GDP, while others find a threshold greater than 13 percent of GDP, or between about $2 trillion and $3.8 trillion (at 2024:Q4 GDP levels).7

A more straightforward approach would be to ask banks how many reserves they want to hold, and the Federal Reserve has done this with the Senior Financial Officer Survey (SFOS, 2023), which asks both about a firm’s lowest comfortable level of reserves (LCLoR), its tolerance for fluctuations around that level, and its preference for holding reserves above that level, among other questions. Calculating the aggregate LCLoR for all banks from the survey responses, the Federal Reserve Bank of New York sees numbers in the range of 3 percent to 5 percent of GDP (Andros et al., 2019), or between about $900 billion and $1.5 trillion.

Nevertheless, even assuming that the precise boundary was known, shifts in the demand for reserves from banks and changes in the supply coming from factors such as the TGA mean that the FOMC might not want to target that boundary too closely lest a big demand for cash or a jump in the TGA make reserves scarce and overnight interest rates jump. This problem is akin to deciding how early to arrive at the airport. Getting there too early means wasting time at the airport, but arriving too late means possibly missing the flight. The key is to choose a buffer that addresses the two costs by finding a balance between letting the federal funds rate get too high versus having a larger balance sheet. The approach outlined below, which by no means is the only one, is based on Haubrich (2023).

In order to find the right buffer for the balance sheet, the first concern is defining what it means for the federal funds rate to be “too high.” The FOMC has set a target range of 25 basis points (0.25 percent) for this; however, it usually keeps the rate within a narrower span between the bottom of the official range and the interest rate paid on reserves (which was 15 basis points in March 2025). Therefore, a reasonable measure of the federal funds rate’s getting too high would be when the usual measure, the effective federal funds rate (EFFR), rises above the IORB rate. This would be the reserve equivalent of missing the plane.

Since the Fed started paying interest on reserves in October 2008, the EFFR has exceeded the IORB rate less than 5 percent of the time. Over most of this period, however, the FOMC was using the balance sheet to combat the Great Recession and then the COVID-19 downturn. However, from 2018 until the start of the pandemic, the FOMC had reduced its balance sheet and adjusted the IORB rate “to keep rates well within the FOMC’s target range” (Board of Governors, 2018). During this period, the EFFR exceeded the IORB rate 30 percent of the time.

Assuming the FOMC was content with how often the EFFR rose above IORB over that timeframe, inventory theory can draw some implications. Since the probability of running out of stock depends on the relative costs of running out or holding too much, it depends sensitively on their ratio. Therefore, how often the EFFR exceeds the IORB rate (that is, runs out of stock) provides information about these costs. In fact, since the key factor in this calculation is the ratio, how often the EFFR exceeds the IORB gives a relative estimate of the two costs. A probability of 30 percent translates into the cost of running out as being about three times as great as the cost of holding too much. The costs involved are somewhat subjective and difficult to measure, but on a purely monetary basis, Lucas (2022) noted that between 2008 and 2019, the interest rate on reserves exceeded the interest rate on three-month Treasury bills by 15 basis points, meaning that the Federal Reserve was losing $1.5 million per $1 billion of extra funds on the balance sheet. However, inventory theory would imply that having reserves $1 billion too low would cost nearly three times as much, or approximately $4.5 million.

Cost aside, the inventory model can be used to estimate the buffer by looking at the size of fluctuations in the supply of reserves. Based on changes in reserves over the period during the ample reserves regime starting in December 2015, when the FOMC raised its target from the lower bound, I estimate an optimal buffer of around $90 billion to $130 billion. Other estimates from the inventory model that include possible demand shocks can lead to higher numbers in the range of $800 billion to $860 billion. This range of estimates reveals considerable uncertainty about the size of the needed buffer. To put these buffer estimates in context, recall from earlier that survey estimates of the lowest comfortable level of reserves are in the range of $900 billion to $1.5 trillion, while other estimates of the point at which reserves become scarce range from about $2 trillion to $3.8 trillion.

Conclusion

The FOMC rapidly increased its balance sheet to fight the ravages of the Great Recession and the COVID-19 pandemic. As the recoveries after each event progressed, the FOMC then implemented QT, by letting assets roll off, to reduce the balance sheet. In deciding when to stop QT, the FOMC will need to balance the costs of a large balance sheet against variability in the federal funds rate. Different preferences about that size versus variability tradeoff, and different theories about how the federal funds market operates, lead to different conclusions regarding how far the process may go. Using inventory theory, some estimates suggest the size of the buffer needed to keep reserves ample is small relative to the amount of reserves needed to be in the ample range. However, other estimates can be considerably higher, making progress in reducing the size of the Federal Reserve’s balance sheet something to be watched closely.

References

- Afonso, Gara, Gabriele La Spada, and John C. Williams. 2022. “Measuring the Ampleness of Reserves.” Liberty Street Economics (blog). Federal Reserve Bank of New York. October 5, 2022. https://libertystreeteconomics.newyorkfed.org/2022/10/measuring-the-ampleness-of-reserves/.

- Andros, Joseph, Michael Beall, Francis Martinez, Tony Rodrigues, Mary-Frances Styczynski, and Alex Thorp. 2019. “Approaches to Estimating Aggregate Demand for Reserve Balances.” FEDS Notes. Board of Governors of the Federal Reserve System. https://doi.org/10.17016/2380-7172.2459.

- Board of Governors of the Federal Reserve System. 2008. “Board Announces That It Will Begin to Pay Interest on Depository Institutions Required and Excess Reserve Balances.” Press Release October 6, 2008. https://www.federalreserve.gov/monetarypolicy/20081006a.htm.

- Board of Governors of the Federal Reserve System. 2023. “September 2023 Senior Financial Officer Survey Results.” https://www.federalreserve.gov/data/sfos/september-2023-senior-financial-officer-survey.htm.

- Board of Governors of the Federal Reserve System. 2025. “H.4.1: Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks, March 20, 2025.” Statistical Release. https://www.federalreserve.gov/releases/h41/20250320/.

- Federal Open Market Committee. 2018. “Minutes of the Federal Open Market Committee, November 7-8, 2018.” Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/monetarypolicy/fomcminutes20181108.htm.

- Federal Open Market Committee. 2019. “Statement Regarding Monetary Policy Implementation and Balance Sheet Normalization.” Press Release January 30, 2019. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/pressreleases/monetary20190130c.htm.

- Federal Reserve Bank of New York. 2024. “Open Market Operations During 2023: A Report Prepared for the Federal Open Market Committee by the Markets Group of the Federal Reserve Bank of New York.” https://www.newyorkfed.org/medialibrary/media/markets/omo/omo2023-pdf.pdf.

- Gagnon, Joseph E., and Brian Sack. 2019. “Recent Market Turmoil Shows That the Fed Needs a More Resilient Monetary Policy Framework.” Peterson Institute for International Economics. RealTime Economics (blog). September 26, 2019. https://www.piie.com/blogs/realtime-economic-issues-watch/recent-market-turmoil-shows-fed-needs-more-resilient-monetary.

- Haubrich, Joseph G. 2023. “Federal Reserve Balance-Sheet Policy in an Ample Reserves Framework: An Inventory Approach.” Working paper 23-25. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202325.

- Huther, Jeffrey, Luke Pettit, and Mark Wilkinson. 2019. “Fiscal Flow Volatility and Reserves.” FEDS Notes. Board of Governors of the Federal Reserve System. https://doi.org/10.17016/2380-7172.2470.

- Langowski, Friederike. 2023. “Do Bank Reserves Affect Interest Rates When Reserves Are Abundant?” Working paper. https://fk-langowski.github.io/assets/pdf/fk-langowski_jmp.pdf.

- Lopez-Salido, David, and Annette Vissing-Jorgensen. 2023. “Reserve Demand, Interest Rate Control, and Quantitative Tightening.” Working paper. https://doi.org/10.2139/ssrn.4371999.

- Lucas, Deborah. 2022. “Some Fiscal Implications of Federal Reserve Balance Sheet Policies, Revisited.” Prepared for the Shadow Open Market Committee meeting at Chapman University, June 23, 2022.

- Santoro, Paul J. 2012. “The Evolution of Treasury Cash Management during the Financial Crisis.” Current Issues in Economics and Finance 18 (3). https://www.newyorkfed.org/research/current_issues/ci18-3.html.

- Schnabel, Isabel. 2024. “The Eurosystem’s Operational Framework.” Speech at the Money Market Contact Group Meeting, Frankfurt Am Main, March 14, 2024. European Central Bank. https://www.ecb.europa.eu/press/key/date/2024/html/ecb.sp240314~8b609de772.en.html.

- Wolla, Scott A. 2019. “A New Frontier: Monetary Policy with Ample Reserves.” Page One Economics, May 2019. https://research.stlouisfed.org/publications/page1-econ/2019/05/03/a-new-frontier-monetary-policy-with-ample-reserves.

Endnotes

- Policy concerns such as how fast the balance sheet should run off and whether QT should stop if the FOMC reduces the target range for the federal funds rate are certainly of interest; however, they are outside the purview of this paper. Return to 1

- The exact formula for the interest paid is a bit complicated since at the time there was a distinction between required and excess reserves. For more details, see Board of Governors press release of October 6, 2008. Required reserves were eliminated in 2020, and interest on reserves denoted interest on reserve balances (IORB) instead of interest on excess reserves (IOER). Return to 2

- As emphasized by Schnabel, 2024. Return to 3

- Both figures are as of March 19, 2025. Return to 4

- It was not always so. See Paul J. Santoro, 2012, and Huther et al., 2019. Return to 5

- From the March 20, 2019, Balance Sheet Normalization Principles and Plans, federalreserve.gov/newsevents/pressreleases/monetary20190320c.htm. Return to 6

- See, for example, Langowski, 2023; Lopez-Salido and Vissing-Jorgensen, 2023; and Afonso et al., 2022. Return to 7

Suggested Citation

Haubrich, Joseph G. 2025. “QT, Ample Reserves, and the Changing Fed Balance Sheet.” Federal Reserve Bank of Cleveland, Economic Commentary 2025-05. https://doi.org/10.26509/frbc-ec-202505

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

- Share

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.